What is CRS? Why are rich people also afraid?

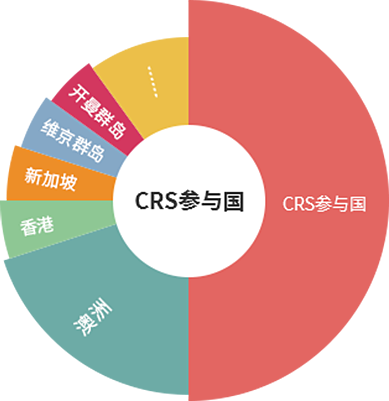

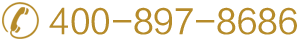

CRS is the English abbreviation of Common Reporting Standard, and is a standard for automatic exchange of tax-related information on financial accounts proposed by the Organization for Economic Cooperation and Development (OECD). To put it simply, it requires the signatories to mutually disclose the economic assets of the citizens of the other country in order to improve tax transparency and combat cross-border tax evasion. Currently, 101 countries and regions have committed to implement CRS.

Learn more about CRS

CRS is fierce!Wealth is fully transparent and automatically exchanged!

Information to be exchanged

-

Overseas Institution Account Type

Financial institutions including depository institutions, custodian institutions, investment institutions, and specific insurance companies.

-

Account content

Deposit accounts, custody accounts, cash hedging insurance contracts, annuity contracts, and equity/bond rights of financial institutions.

-

Asset information type

Name, date of birth, tax residence, account and account balance, and the total amount paid to or credited to the account each year.

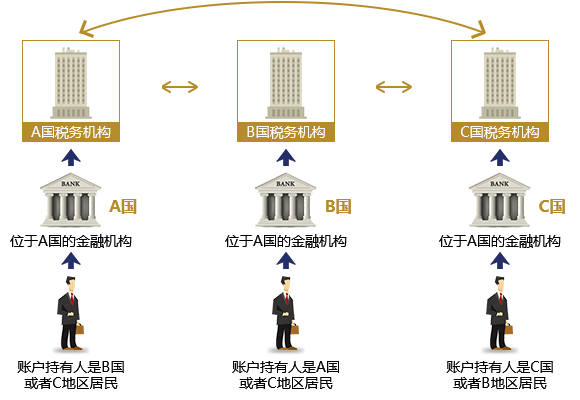

Automatic exchange

ountry (or region) tax information exchange

Country (or region) tax information delivery

SixAffected people

-

Have immigrated overseas

According to the CRS agreement, whether your assets are in your home country or you have immigrated overseas and registered as a tax resident of that country, the financial assets you hold in China will be known by your home country and the country of immigration, and then tax collection and inspection will follow. And this information exchange is carried out once a year.

-

-

Bought a large life insurance policy overseas

If you have purchased a large-value policy in the CRS contract area (including Hong Kong), the policy information will be disclosed to the China Taxation Bureau. Not only will the newly purchased policies be disclosed in 2017, but the policies that have been purchased in history will be disclosed.

-

Holding shell company investment and financial management overseas

If you are a Chinese and set up a company in a region with very favorable overseas taxation, hold assets through the company's bank account and other financial institutions, and use the company account for financial management, then the financial assets owned by you and the company will be disclosed.

-

People who set up a family trust overseas

CRS stipulates that relevant information about established family trusts should also be disclosed, including the settlor (namely the settlor), protector, trustee (through a trust institution), and beneficiaries of the family trust. Basically all parties are involved Within range.

-

Those who allocate financial assets overseas

You are a Chinese, regardless of whether you emigrate or not, the country or region where your overseas financial assets are deposited will disclose your financial assets to the China Taxation Bureau. Your source of funds, legality, and whether you pay taxes will all be checked.

-

-

Set up a company overseas to engage in international trade

According to the law, some companies set up by Chinese bosses overseas are regarded as Chinese tax resident companies and should pay 25% of corporate income tax in accordance with Chinese government regulations. However, most of these company bosses have not voluntarily declared, and CRS will become a major crisis for them.

-

Facing risks: full exposure of wealth, explanation of source of property, traceability of tax liability